Rajkotupdates.news: Impact of the Third Wave of Corona on Life Insurance

Rajkotupdates.news is a leading news portal that covers news related to various sectors such as politics, entertainment, sports, health, and finance. In this blog post, we will focus on the impact of the third wave of corona on life insurance and how Rajkotupdates.news has covered this topic.

The Third Wave of Corona and its Impact on Life Insurance

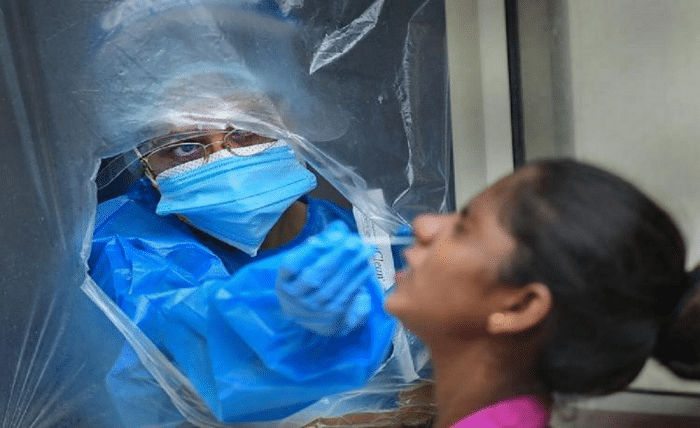

The third wave of corona is expected to hit India soon, and it is expected to be more severe than the previous waves. The impact of the third wave of corona is not only limited to the health sector but also extends to other sectors such as the economy, finance, and insurance.

Life insurance is one such sector that is expected to be impacted by the third wave of corona. With the rise in the number of covid cases, the demand for life insurance is expected to increase, as people become more aware of the importance of having adequate life insurance coverage.

Importance of Life Insurance During the Third Wave

Life insurance is an essential financial tool that provides financial security to the policyholder’s family in case of their untimely death. The third wave of corona has highlighted the importance of life insurance, as it has become clear that anyone can be affected by this deadly virus, regardless of age or health status.

In case of the policyholder’s death due to corona, the life insurance policy can provide financial support to the family, which can help them cover their daily expenses, medical bills, and other liabilities. The life insurance payout can also help the family pay off any outstanding debts or mortgages and maintain their lifestyle.

Changes in the Life Insurance Sector Due to the Third Wave

The third wave of corona has also brought about changes in the life insurance sector. Insurance companies have started to offer policies that cover covid-related deaths and illnesses. These policies provide coverage for hospitalization expenses, medical bills, and other related expenses.

Insurance companies have also introduced policies that offer additional benefits such as critical illness coverage, disability coverage, and accidental death coverage. These policies provide financial protection to the policyholder in case of any unforeseen event, such as a critical illness or disability.

The life insurance sector has also witnessed an increase in the number of online policy purchases, as people prefer to buy policies online rather than visiting physical branches due to the fear of contracting the virus. This has led to a surge in the number of online policies being sold by insurance companies.

Rajkotupdates.news has covered these changes in the life insurance sector in detail, providing valuable insights into the new policies being offered by insurance companies and the changing dynamics of the insurance sector.

Conclusion

In conclusion, the third wave of corona is expected to impact various sectors, including the life insurance sector. Rajkotupdates.news has provided comprehensive coverage of the impact of the third wave on the life insurance sector, highlighting the importance of life insurance during these challenging times.

The changes in the insurance sector due to the third wave have led to the introduction of new policies that offer coverage for covid-related deaths and illnesses, critical illnesses, and disabilities. These policies provide financial security to the policyholder and their family in case of any unforeseen event, providing peace of mind in these uncertain times.

Read more about: fingerlakes1